Hey bestie,

Let’s be honest about what you really want:

The rich girl life. Not just the aesthetic – the actual MONEY. The financial security. The “I can afford that” freedom. The abundance mindset. The quality over quantity lifestyle.

You want to save for nice things without guilt. Invest in yourself. Travel. Build wealth. Live well. Look expensive.

But right now? You’re living paycheck to paycheck wondering how rich girls do it.

Here’s the truth: Rich girls aren’t just lucky. They make strategic money moves, have abundance mindset, and build wealth intentionally.

Most “financial advice” is either too vague (“save more!”) or too aggressive (“never buy coffee!”). Neither works.

That’s why I’m giving you 26 specific rich girl goals for 2026 – real financial strategy plus rich girl energy.

These aren’t “be richer” wishes. These are strategic, achievable actions that build actual wealth AND the rich girl lifestyle.

Pick 2-3 per month. By December 2026, you’ll have money in the bank, investments growing, and rich girl confidence while everyone else is still broke and stressed.

✨ Want the complete framework? Download my free Pinterest to Dream Life Starter Kit — it includes strategic planning for building the rich girl life you want.

Let’s make 2026 your rich girl year.

RICH GIRL GOALS FOR 2026 (1-26)

MONEY FOUNDATION GOALS (1-5)

Goal #1: Save $5,000 Emergency Fund

What success looks like: $5K in savings account, untouched

Why it matters: Rich girls have cushion, not stress

How to achieve: $420/month, automate transfers, sacrifice for 12 months

Goal #2: Track Every Dollar for 90 Days

What success looks like: Know exactly where money goes daily

Why it matters: Can’t build wealth without awareness

How to achieve: Use app (Mint, YNAB), log everything, analyze patterns

Goal #3: Eliminate One Debt Completely

What success looks like: One credit card, loan, or debt paid off fully

Why it matters: Rich girls don’t have debt draining their money

How to achieve: Smallest debt first, aggressive payments, avalanche method

Goal #4: Create Sustainable Budget (50/30/20)

What success looks like: 50% needs, 30% wants, 20% savings/debt consistently

Why it matters: Structure creates wealth

How to achieve: Calculate after-tax income, allocate strictly, adjust monthly

Goal #5: Never Overdraft Account

What success looks like: Zero overdraft fees entire year

Why it matters: Rich girls don’t pay poor taxes

How to achieve: Buffer in checking, track daily, turn off overdraft

INCOME INCREASE GOALS (6-10)

Goal #6: Negotiate 10%+ Raise

What success looks like: Salary increase at current job

Why it matters: Biggest wealth builder is earning more

How to achieve: Document wins, research market rate, ask confidently

Goal #7: Start Side Income Stream

What success looks like: $500+/month from side hustle

Why it matters: Rich girls have multiple income sources

How to achieve: Digital products, freelancing, or service based on your skills

Goal #8: Increase Rates or Prices 20%

What success looks like: If freelance/business, raise prices successfully

Why it matters: Your time is valuable, charge accordingly

How to achieve: Grandfather existing clients, new clients pay more

Goal #9: Apply to 12 Higher-Paying Jobs

What success looks like: One application monthly for better opportunities

Why it matters: Sometimes you need to leave to level up

How to achieve: Set calendar reminder, apply first of month, stay ready

Goal #10: Learn High-Income Skill

What success looks like: Skill that commands $50+/hour

Why it matters: Rich girls are valuable and know it

How to achieve: Choose one (copywriting, design, sales, coding), master it

INVESTMENT & WEALTH BUILDING GOALS (11-15)

Goal #11: Max Out Roth IRA ($7,000)

What success looks like: Full $7K contribution to Roth IRA

Why it matters: Rich girls build wealth, not just income

How to achieve: $584/month automated, start January 1st

Goal #12: Start Investing in Index Funds

What success looks like: Regular monthly investments in S&P 500 or total market

Why it matters: Compound interest builds generational wealth

How to achieve: Open brokerage (Vanguard, Fidelity), auto-invest monthly

Goal #13: Contribute to 401(k) for Full Match

What success looks like: Max employer match (free money)

Why it matters: Leaving match on table is leaving money

How to achieve: Adjust payroll contribution, get full match minimum

Goal #14: Open High-Yield Savings Account

What success looks like: Savings earning 4%+ instead of 0.01%

Why it matters: Rich girls make their money work for them

How to achieve: Research Marcus, Ally, or Wealthfront, transfer funds

Goal #15: Learn Investing Basics

What success looks like: Understand stocks, bonds, index funds, compound interest

Why it matters: Financial literacy = financial freedom

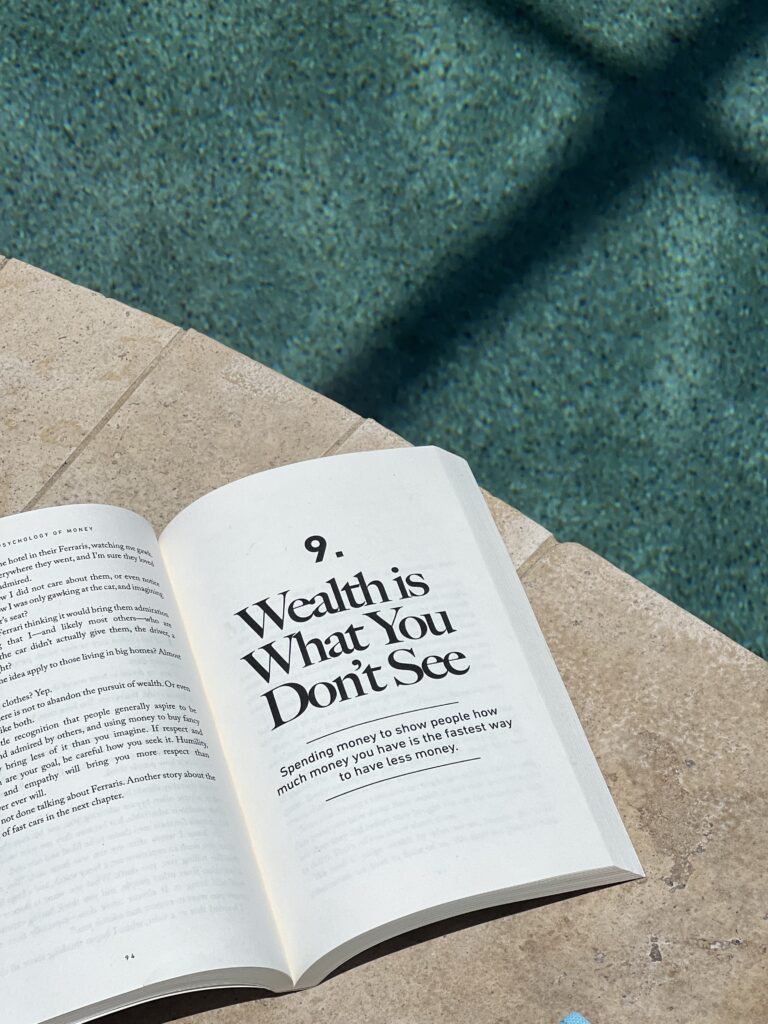

How to achieve: Read “Simple Path to Wealth,” follow r/personalfinance, educate yourself

SPENDING & LIFESTYLE GOALS (16-20)

Goal #16: Buy Quality Over Quantity

What success looks like: Fewer items, better quality, longer lasting

Why it matters: Rich girl aesthetic is expensive-looking, not expensive

How to achieve: One quality piece over three cheap ones, research before buying

Goal #17: Wait 48 Hours Before Non-Essential Purchase

What success looks like: Two-day rule for all wants

Why it matters: Impulse spending keeps you broke

How to achieve: Add to cart, wait 48 hours, still want it? Buy it.

Goal #18: Invest in Capsule Wardrobe

What success looks like: 30-50 quality neutral pieces

Why it matters: Rich girls look expensive without overspending

How to achieve: Declutter first, buy intentionally, quality fabrics

Goal #19: Upgrade One Thing to Luxury

What success looks like: Save for ONE quality luxury item (bag, coat, jewelry)

Why it matters: Rich girls have signature investment pieces

How to achieve: Save monthly, research, buy timeless classic

Goal #20: Eliminate One Subscription Monthly

What success looks like: Cut $10-50/month in unused subscriptions

Why it matters: Death by a thousand subscriptions keeps you poor

How to achieve: Audit bank statement, cancel unused, redirect to savings

MINDSET & ENERGY GOALS (21-23)

Goal #21: Practice Abundance Affirmations Daily

What success looks like: Daily affirmations about wealth and abundance

Why it matters: Rich girl mindset attracts rich girl life

How to achieve: Morning affirmations, vision board, reprogram scarcity mindset

Goal #22: Stop Saying “I Can’t Afford It”

What success looks like: Replace with “How can I afford it?” or “Not a priority”

Why it matters: Language shapes reality

How to achieve: Catch yourself, reframe, shift from scarcity to strategy

Goal #23: Surround Yourself with Financially Ambitious People

What success looks like: Friends who talk about investing, building, growing

Why it matters: You become who you surround yourself with

How to achieve: Join communities, follow finance creators, distance from broke mindset

CAREER & PROFESSIONAL GOALS (24-26)

Goal #24: Build Professional Network

What success looks like: 50+ quality LinkedIn connections, attend networking events

Why it matters: Rich girls know opportunities come through people

How to achieve: Comment on posts, reach out, coffee chats, add value

Goal #25: Document Your Professional Wins

What success looks like: Running list of accomplishments for reviews/interviews

Why it matters: Rich girls know their worth and prove it

How to achieve: Weekly wins journal, quantify impact, build case for raises

Goal #26: Live Like Money Loves You

What success looks like: Handle money with respect, gratitude, and strategy

Why it matters: This IS the goal – rich girl energy with rich girl actions

How to achieve: Organize finances, track growth, celebrate wins, stay disciplined

HOW TO ACTUALLY ACHIEVE THESE (Not Stay Broke)

Don’t try to do all 26 in January. Financial transformation requires strategy.

The Strategic Rich Girl Approach:

January (Goals 1-2): Financial foundation (start emergency fund, track spending)

February (Goals 3-4): Debt and budget (eliminate debt, create budget)

March (Goal 5): Master banking basics (no overdrafts)

April (Goals 6-7): Increase income (negotiate raise, start side hustle)

May (Goals 8-9): Income expansion (raise rates, apply to jobs)

June (Goal 10): Skill building (learn high-income skill)

July (Goals 11-12): Start investing (Roth IRA, index funds)

August (Goals 13-14): Investment expansion (401k, HYSA)

September (Goal 15): Financial education

October (Goals 16-18): Spending strategy (quality over quantity, waiting period, capsule)

November (Goals 19-20): Luxury + cuts (one luxury item, eliminate subscriptions)

December (Goals 21-26): Mindset, network, and identity mastery

Or focus on Income + Saving + Investing simultaneously.

The key: Earn more, spend intentionally, invest consistently.

THE BROKE GIRL VS. THE RICH GIRL

Broke Girl:

- Lives paycheck to paycheck

- No emergency fund

- Impulse buys cheap items

- Scared to talk about money

- “I can’t afford it” mindset

- Still broke in December

2026 Rich Girl (You):

- Has 3-6 months expenses saved

- Investing monthly

- Buys quality intentionally

- Discusses money confidently

- “How can I afford it?” mindset

- Building wealth by December

The difference? Strategy, not salary.

WHY “SAVE MORE” FAILS (And How These Won’t)

Vague money goals fail because: ❌ “Save more” – but how much? by when?

❌ No income strategy (can’t save what you don’t earn)

❌ All restriction, no abundance

❌ No tracking or accountability

❌ Shame-based, not strategy-based

These rich girl goals work because: ✅ Specific amounts and deadlines

✅ Increase income AND decrease waste

✅ Abundance mindset + practical action

✅ Built-in tracking

✅ Strategy-based wealth building

You can’t budget your way to wealth. You need to earn more, invest smarter, and spend intentionally.

THE RICH GIRL MONEY RULES

Rule 1: Pay Yourself First

Savings and investing come out first, not last.

Rule 2: Automate Everything

Rich girls don’t rely on willpower for money moves.

Rule 3: Track Obsessively

Can’t manage what you don’t measure.

Rule 4: Invest in Appreciating Assets

Education, skills, index funds – things that grow in value.

Rule 5: Quality Over Quantity Always

One $100 item that lasts > five $20 items that don’t.

Rule 6: Make Money Decisions from Abundance

Ask “Does this align with rich girl me?” not “Can I technically afford this?”

Rule 7: Your Network is Your Net Worth

Surround yourself with people who elevate your financial game.

TRACKING YOUR RICH GIRL TRANSFORMATION

Monthly Money Meetings with Yourself:

What to Track:

- Net worth (assets – liabilities)

- Savings account balance

- Investment account balance

- Income (salary + side hustle)

- Spending by category

- Progress on each goal

Quarterly Reviews:

- Which goals achieved?

- What’s working financially?

- What needs adjustment?

- Net worth growth?

Year-End Assessment:

- Compare December 2026 to January 2026

- How much wealth did you build?

- What changed about your money relationship?

The difference between December you and January you should be shocking.

THE RICH GIRL STARTER PACK

Free Upgrades:

- Track every dollar (awareness is free)

- Negotiate bills (call and ask for discounts)

- Stop buying cheap crap (use what you have)

- Learn about investing (YouTube, books, podcasts)

- Abundance affirmations (mindset shifts cost nothing)

Worth Investing In:

- High-yield savings account (better interest)

- Index fund investments (start with $100)

- One quality piece over multiple cheap ones

- Financial education (books, courses)

- Professional headshots (for career growth)

Rich Girl Mindset (Priceless):

- Money is a tool, not identity

- Wealth is built, not found

- Abundance is available to you

- Financial freedom is the goal

- You’re capable of building wealth

THE REALITY CHECK

Building wealth takes time.

Month 1-3: Feels like nothing is changing

Month 4-6: Small progress visible

Month 7-9: Momentum building

Month 10-12: Transformation undeniable

The rich girls you see? They built it over years, not months.

But the compound effect is real:

- Save $400/month = $4,800/year

- Invest $500/month at 10% = $6,000+ first year

- Side hustle $500/month = $6,000/year

- Negotiate $5K raise = $5,000/year

That’s $21,800+ difference in one year.

In 5 years? Over $100K.

That’s how rich girls are made.

START WITH GOAL #1 THIS WEEK

Don’t wait until January 1st. Start this week.

Pick Goal #1: Start your $5K emergency fund.

Open high-yield savings account today.

Transfer $50 this week.

Set up automatic $420 monthly transfer.

By January 1st when everyone’s making money resolutions, you’ll already have savings.

By December when they’ve quit, you’ll have $5K in the bank.

The rich girl life isn’t built on New Year’s Day. It’s built through strategic money moves all year long.

Your 2026 rich girl transformation starts now.

👉 Download your free Pinterest to Dream Life Starter Kit — Get the strategic framework for planning your rich girl life with financial goals, income strategy, and abundance mindset.

👉 Get the Glow Up SOS Kit ($7) — Reprogram your money mindset with rich girl affirmations for abundance, wealth, and financial confidence as you work toward these goals.

26 goals. 365 days. Wealth transformation.

Make 2026 your rich girl year.

Xo,

Chelsea Elise

Skip to content

Skip to content